Week Ahead: 12 May 2025

Post markets fell after Moody's downgraded U.S. credit rating to Aa1. Many has anticipated this downgrade but will be watchful during early week trading.

Medium Term:

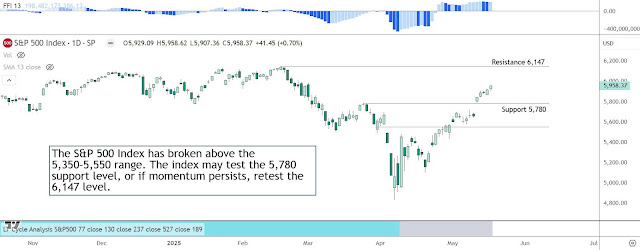

S&P 500 (SPX): The S&P 500 Index has broken above the 5,350–5,550 range. The index may test the 5,780 support level, or if momentum persists, retest the 6,147 level.

Consider long positions above 5,780 with upside target at 6,147. Use tight stops below 5,750 to manage risk.

Hang Seng Index (HSI): Our China Market Long-Term Cycle Indicator continues to signal an upward trend for HK/China markets. The Hang Seng Index (HSI) is expected to trade sideways, with the possibility of testing support around the 22,750 level.

Alternatively, the index's uptrend could extend toward the 24,200 resistance level.

Range-bound trading favoured between 22,750–24,200. Enter longs near 22,750 support with stops below 22,400. Consider breakout trades if index clears 24,200.

Straits Times Index (STI): The Straits Times Index (STI) outlook remains. Our base case anticipates a retest of the 4,000 zone. Alternatively, the index may consolidate within the 3,800–3,900 range.

Focus on break above 3,900 to initiate longs targeting 4,000. Use the 3,800–3,900 range for short-term range trading setups.

Long Term:

S&P 500 (SPX) Neutral Trend

Hang Seng Index (HSI) Upward Trend

Straits Times Index (STI) Uptrend Trend

Headlines Next Week:

US Corp Earnings: Home Depot, Palo Alto

SG Corp Earnings: Singtel, SATS

US: G7 FinMin summit, Fed speakers, housing data, initial jobless claims, S&P mfg & services PMI.

China: LPR decision, Apr IP, retail sales, property data, surveyed jobless rate.

Singapore: Final 1Q GDP, Apr CPI

Disclaimers apply