Week Ahead: 9 June 2025

The Musk–Trump spat sent Tesla Inc. shares lower, though investors are now awaiting a potential TACO moment. Immediate technical support levels for Tesla (TSLA) are at US$278 and US$250.

A weaker U.S. dollar continues to support Asian equities, particularly in China/Hong Kong. Investors are hopeful that underweight global funds may begin to reallocate to China, providing catalyst for the market’s next leg up.

Medium Term:

S&P 500 (SPX): The index has broken above the 5,970 resistance level, with the potential to retest the February high of 6,147. However, volume—particularly as indicated by the Fund Flow Indicator (FFI)—needs to improve. If FFI remains weak, S&P 500 may face near-term consolidation or weakness.

In the meantime, our Long-Term Cycle Indicator for US Equities has reverted to an upward trend.

Bias remains bullish. Consider tactical longs above 5,970 targeting 6,147, with stops below 5,940.

Hang Seng Index (HSI): Hang Seng tested and rebounded from our 22,750 support level. We now hold stronger conviction that the index’s upward trend remains intact and is expected to retest the 24,200 level.

Positive bias remains intact. Consider long trades with entries on minor pullbacks above 23,000, targeting 24,200. Maintain stops below 22,750.

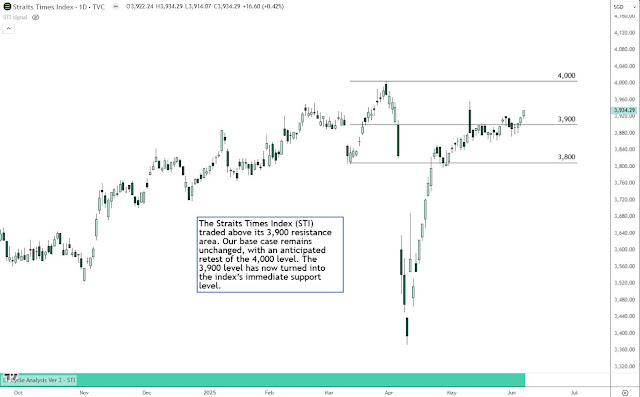

Straits Times Index (STI): STI traded above its 3,900 resistance area. Our base case remains unchanged, with an anticipated retest of the 4,000 level. The 3,900 level has now turned into the index’s immediate support level.

Short-term bullish bias. Consider longs with a retest and hold of 3,900 as support, targeting 4,000.

Long Term:

S&P 500 (SPX) Upward Trend

Hang Seng Index (HSI) Upward Trend

Straits Times Index (STI) Uptrend Trend

Headlines Next Week:

US: May CPI, PPI, consumer confidence

China: May CPI, PPI, trade, new yuan loans, FDI

Disclaimers apply