S&P 500

HSI

Thoughts on Week Ahead:

Week 6 Feb 2023

Market Outlook

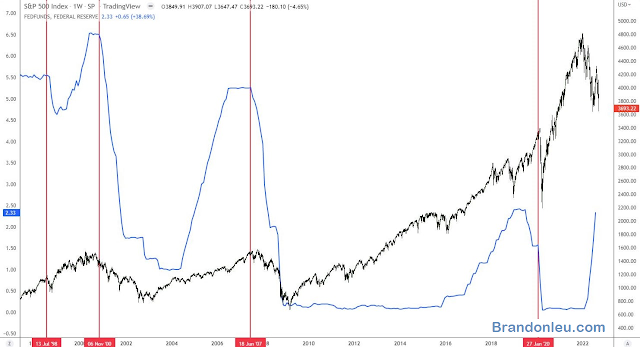

How strong was Friday’s US Jobs report? Strong enough to cause interest rate futures to shift by 25bps, resulting in a short term trend reversal for DXY, US 2yr Yield, and a selling in US equities market.Outlook aligns with market expectations, US economy will continue to function until 4Q23, when the 1st interest rate cut may occur, and a potential weak stock market.

One other matric we are watching closely is momentum. For current uptrend to continue, we do not want indices to sell below 61.8% Fibonacci retracement level. Breaching this level signals market could trade sideways or may even return back to down trending environment.

Market selling may continue into the week ahead, banks should benefit from Friday’s US jobs report. Nil ideas spotted. We will be seeking out stocks with relative strength that may trend higher as the market stabilizes.

Headlines for Week Ahead:

Earnings Reporting (DIS, PYPL, SGX, Starhub)

Why US markets are concerned about Jobs report? There is a relatively high correlation between labour and inflation.

Danger sign for stock markets is when an inverting yield curve steepens, which is caused mostly by rate cuts and funds shifting to safe haven longer term bonds. Currently, it has yet to occur.

Please read Blog Disclaimers.