Thoughts on Week Ahead:

Week 20 Mar 2023

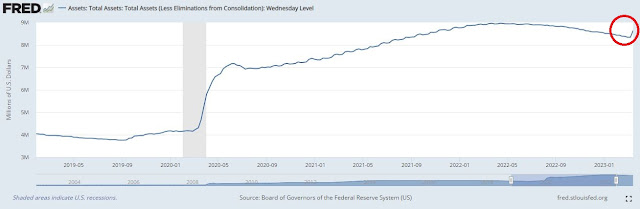

The US Federal Reserve recently injected liquidity into the financial system in an effort to stabilize the banking sector, and market is expecting a 25bps rate hike from the FOMC this Wednesday. Meanwhile, the technology and semiconductor sectors have continued to outperform, while Chinese banks have been quietly rising due to government efforts to boost economic growth.

Investors are diversifying into gold, which has risen 5.96% as the market prices in a potential peak in the interest rate cycle and a resulting softening of the USD.

In the travel industry, stocks within the theme are experiencing more price stability and demand as countries prepare for an expected increase in Chinese arrivals in the coming quarters. For example, Beijing Capital International Airport (694), which we shared, recently reached our target price.

Overall, while there are some positive trends in the market, it's important to consider potential risks and opportunities in each sector and to remain vigilant as events unfold.