German Chancellor Olaf Scholz recently declared that Deutsche Bank is "very profitable," causing markets to pare losses and close in the green on Friday. Amid the recent banking crisis, the market trend continues to exhibit short-to-medium term upward momentum. However, as we enter the second half of 2023 (2H23), investors should exercise caution due to potential interest rate cuts.

Market Trend Amid Banking Crisis

Despite the ongoing banking crisis, the market trend remains on a short-to-medium term uptrend. This is evident from the swift recovery of the markets following Chancellor Scholz's positive statement about Deutsche Bank. The overall market sentiment appears to be cautiously optimistic, buoyed by the robust performance of key players such as Deutsche Bank.

S&P 500 Range Bound Trading and the End of 1Q23

As we approach the end of the first quarter of 2023 (1Q23), the S&P 500 continues to experience range-bound trading. Market participants should keep a close eye on potential directional breakouts as we conclude the quarter. Such breakouts could offer valuable insights into market trends for the coming months and provide opportunities for investors to capitalize on the prevailing market dynamics.

Caution in the Second Half of 2023

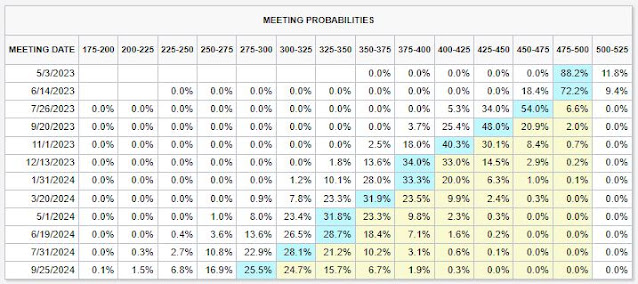

Investors should remain vigilant as we approach 2H23. The current interest rate futures market indicates a possible rate cut during this period. Historically, rate cuts have been employed to create favorable credit conditions in response to a weakening economy. This suggests that the upcoming rate cut may signal economic challenges ahead, warranting investor caution.

While Deutsche Bank's profitability has provided some reassurance to the markets, investors should remain cautious as we move into the second half of 2023. With possible interest rate cuts on the horizon, it is crucial to monitor market trends and adapt investment strategies accordingly. As we conclude the first quarter, the S&P 500's range-bound trading could give way to a directional breakout, providing new opportunities for market participants.

Blog disclaimers apply.

Blog disclaimers apply.