The US economy is growing, at 2% for 1Q23, even amid high interest rates. This report would confirm the hawkish stance from the Federal Reserve to increase two more hikes in 2H23 but it’s a sign of a resilient economy.

S&P500 is nearing our 2nd target at 4,500 (above) and we expect the index to test the resistance level. In absence of supply trades, we could see the index trending higher. Recent technical gap (4,422-4,396) provides support for S&P500. In any event this level is breached, we would reassess the direction of current uptrend.

Strategists have been conservative in their year-end S&P 500 calls (above). We expect them to re-rate their target prices and this could potentially fuel the next leg of the current mark up.

The GDP data is also expected to provide some boost for broader market and smaller capitalised stocks (above) have lagged behind larger cap stocks in the recent rally, as investors search for value within the current bull market.

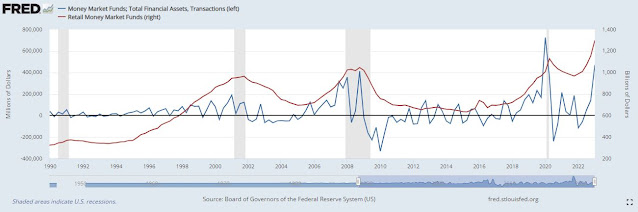

There are still un-invested funds on the sideline (above). They could be potential source of flows for equities market.

Singapore market (STI) continues to trend down in recent months (above). However, there are some selective long trades that could be considered. Investors should carefully evaluate the risks before entering any long positions.

Headlines for Week Ahead:

US FOMC minutes

US Jun NFP & Jobs Report

China Jun PMI Report

SG Jun PMI Report

SG Jun Retail Sales Report

US market, short trading week (Independence Day)

Blog disclaimers apply

%20Brandon%20Leu%20Market%20Technician.JPG)