Week Ahead: 2 June 2025

Deal or no deal—markets are bracing to ride the U.S. tariff roller coaster in the week ahead. On a brighter note, the U.S. April PCE report helped calm equities as inflation remained subdued despite renewed tariff concerns.

Meanwhile, Singapore banks declined 0.60%–1.00% on Friday, following a dip in April bank loan growth after March’s record high.

Medium Term:

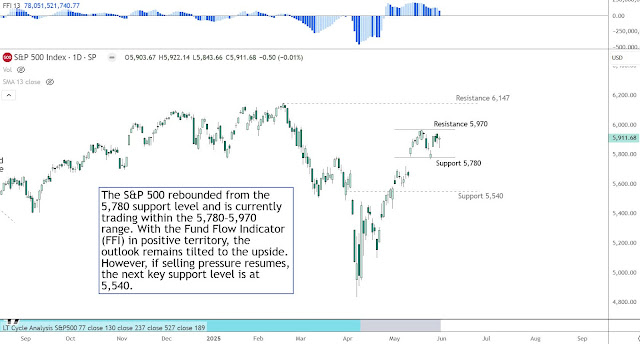

S&P 500 (SPX): The S&P 500 rebounded from the 5,780 support level and is currently trading within the 5,780–5,970 range. With the Forward Flow Indicator (FFI) in positive territory, the outlook remains tilted to the upside. However, if selling pressure resumes, the next key support level is at 5,540.

Hang Seng Index (HSI): Our China Market Long-Term Cycle Indicator continues to signal an upward trend for the HK/China markets. The Hang Seng Index (HSI) recovery remains intact. But our near-term outlook for the index is sideways, with potential support at the 22,750 level.

Alternatively, the uptrend could extend toward the 24,200 resistance level.

Trade the range with a neutral-to-bullish bias. Consider entries near 22,750 support and partial profit-taking near 24,200 resistance. Maintain stop-loss levels below 22,500.

Straits Times Index (STI): The Straits Times Index (STI) continues to test the 3,900 resistance for a second time. Our base case remains unchanged, anticipating a retest of the 4,000 zone. However, the index may consolidate within the 3,800–3,900 range this week if demand does not strengthen.

Trade within the 3,800–3,900 consolidation band. Short-term bullish bias above 3,900 could open upside momentum. Set stops below 3,780 on downside breaks.

Long Term:

S&P 500 (SPX) Neutral Trend

Hang Seng Index (HSI) Upward Trend

Straits Times Index (STI) Uptrend Trend

Headlines Next Week:

US Earnings: Broadcom, CrowdStrike

US: May ISM mfg/services, JOLTS, NFP, unemployment, wages, factory orders, Fed Beige Book, Powell and Fed speeches

China/HK: Caixin mfg/services PMI, May FX reserves, Dragon Boat holiday.

Singapore: Shangri-La Dialogue, May PMI, S&P PMI, Apr retail sales

Disclaimers apply